10 E-Wallet Apps That Every Filipino and Tourist Must Use

Category: Apps

TIER10 AUTHOR

January 29, 2023

Disclosure: Our website contains affiliate links. This means that if you make a purchase through these links, we may receive a commission or other compensation.

Category: Apps

January 29, 2023

Last Update

2 years ago

The rise of electronic wallets, also known as e-wallets, is gaining immense popularity in the Philippines. This surge can be attributed to the undeniable convenience, user-friendly interfaces, and cost-effective transactions they offer. E-wallet apps provide a centralized and secure platform where users can store their cash, debit, and credit card information. By a simple tap of a finger, online purchases and money transfers can be swiftly executed without the hassle of repeatedly entering card details.

Whether you’re a local resident or a visitor to the Philippines, having an e-wallet app installed on your smartphone has become an indispensable part of managing quick and secure payments.

E-wallets, also known as electronic wallets, have emerged as digital payment systems that enable individuals to securely store and manage their financial information. These encompass cash, debit card details, and credit card information in a digital format. The key advantage of e-wallets lies in their ability to facilitate online transactions, payments, and money transfers without the need for physical currency or payment cards.

In the Philippines, there is a requirement to register your SIM card before being able to use certain e-wallet services. This is part of the government’s effort to enhance security measures and prevent fraudulent activities.

When registering for an e-wallet service in the Philippines, you will likely be prompted to provide your mobile number. To proceed with the registration, you may need to verify your mobile number by entering a One-Time Password (OTP) sent to your registered SIM card. This process ensures that the e-wallet account is linked to a valid and registered mobile number.

Therefore, in the context of using e-wallets in the Philippines, SIM card registration is indeed necessary. It is important to register your SIM card with a valid identification document as per the regulations set by the National Telecommunications Commission (NTC) to comply with the requirements of both mobile services and certain e-wallet providers.

G-Cash is a mobile money service developed by Globe Telecom in the Philippines. It allows users to send, receive, and save money using their mobile phones. The service can be used to pay for goods and services online or offline, make bank transfers, buy loads, pay bills, and more.

To use G-Cash, customers need to download the app from the Google Play Store or the Apple App Store. Once installed, they need to register for an account by providing their name, mobile number, email address, and date of birth. After successful registration, they will be prompted to create a 6-digit PIN which will be used to authenticate all transactions.

G-Cash is linked to the user’s Globe or TM mobile number so they can easily transfer funds to other G-Cash users even if they are not registered in the app. To do this, they just need to enter the recipient’s mobile number and the amount to be sent. The recipient will then receive a text message notification about the transaction and can claim the funds by entering their own 6-digit PIN.

Users can also use G-Cash to pay for goods and services at participating merchants. To do this, they just need to provide their mobile number and PIN at the point of sale. They can also withdraw cash from ATMs or over the counter at any BDO branch nationwide.

PayMaya is a mobile wallet that allows users to make online payments, transfer money, and even shop without the need for a credit or debit card. It is one of the most popular e-wallet apps in the Philippines and is accepted by most major online merchants. PayMaya is also a great option for tourists as it can be used to withdraw cash from ATMs without incurring any fees.

Coins.ph is a must-have app for every Filipino and tourist. It is an e-wallet that allows you to store, send, and receive money using your mobile phone. With Coins.ph, you can easily pay for your online purchases, bills, and other services. You can also use it to withdraw cash from ATMs and remit money to your loved ones back home.

The app provides a safe and secure way to manage your finances. It uses state-of-the-art security features to protect your money and personal information. So if you’re looking for an e-wallet that is convenient, safe, and easy to use, then Coins.ph is the best choice for you!

Paypal allows users to send and receive money online, and it’s a convenient way to make online purchases. Filipinos can link their bank account or credit card to their Paypal account, making it easy to transfer money back and forth. Paypal is also a safe and secure way to send money, which is important for Filipino users who might be sending money back home to family or friends.

Grabpay is a mobile wallet that allows users to store, send, and receive money. It is one of the most popular e-wallets in the Philippines and is accepted by many businesses. Safe and convenient to use. It uses multiple layers of security to protect user information. Grabpay is a great option for those who want to avoid carrying cash or using a credit card. It can be used to pay for goods and services online or in person.

If you’re looking for an affordable, easy-to-use way to send and receive payments, Wise is a great option. With no subscription required, you can use Wise to send and receive payments in multiple currencies, making it a great choice for businesses with international customers or suppliers. And because Wise uses the real exchange rate, you’ll always get the best possible value when sending money overseas.

ShopeePay is Shopee’s official e-wallet licensed by Bangko Sentral ng Pilipinas is one of the leading e-wallet providers in Southeast Asia. This app allows users to make QR transactions, pay bills, and load their mobile phones. Unlike any other e-wallets ShopeePay is a safe and convenient way to make payments, and it is also accepted at many merchants and businesses.

For unverified accounts, ShopeePay lets you cash in or receive a balance of up to Php 50,000; for verified accounts, you can receive a balance of up to Php 100,000.

Alipay is a multi-purpose app that allows users to make online payments, book tickets, and more. It is one of the most popular e-wallet apps in the Philippines, with over 10 million downloads on the Google Play Store. Alipay also has a features that allow users to split bills with friends, and pay for services such as Grab and LRT/MRT rides.

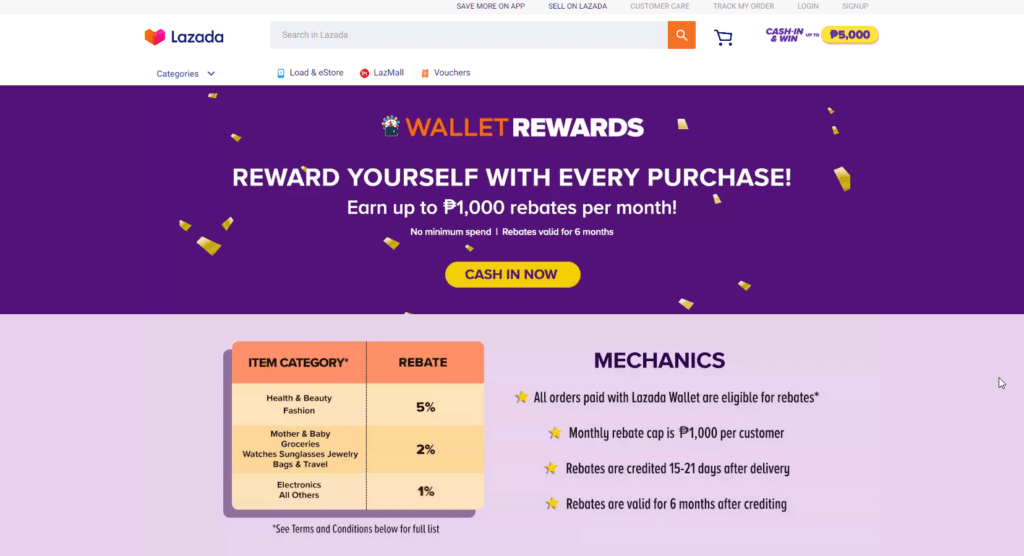

Lazada E-wallet allows you to purchase products and services from Lazada electronically, with just a few clicks, you can top up your e-wallet and use it to pay for your purchases. Lazada e-wallet comes with a Money Back guarantee. So if you’re not happy with your purchase, you can get your money back.

To top up your e-wallet, you can use the cash-in method. This means that you can top up your e-wallet using the following:

Lyke Gem is a mobile wallet app that allows users to store, send, and receive money within the app. The app also allows users to pay for goods and services online and in-app. The app is available for download on the App Store and Google Play Store.

In conclusion, e-wallet apps are an incredibly convenient and secure way to pay for goods online. With the right app, you can make a wide variety of payments quickly and easily. These top 10 e-wallet apps that every Filipino use provide Filipinos with peace of mind when it comes to paying bills or buying products online. They also save time and money by eliminating the need to visit physical outlets or be reliant on cash transactions. We hope this article has helped you identify the best e-wallet app for your needs so that you can start using them as soon as possible!

Top Tier 10 Products is in Partner with Involve, that is designed to provide a means for sites to earn advertising fees by advertising and linking to shops. All product names, logos, and brands are property of their respective owners. All company, product, and service names used on this website are for identification purposes only.

The information provided on this website is for general informational purposes only. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

Copyright © 2022-2023 Top-tier Products. All Rights Reserved.